Cheniere Energy (LNG) and Cheniere Partners (CQP), its midstream subsidiary, are ready to start a new era in the US natural gas industry with the commissioning of the first LNG (Liquefied Natural Gas) export cargo from the U.S. Previously, the US exported LNG only from Alaska. LNG is a clear, odorless, noncorrosive liquid that is formed when natural gas is cooled to around -260 degrees Fahrenheit. This shrinks the volume by about 600 times, making the resource easier to store and transport through marine shipments. Then, liquid is converted back to dry natural gas at regasification plants.

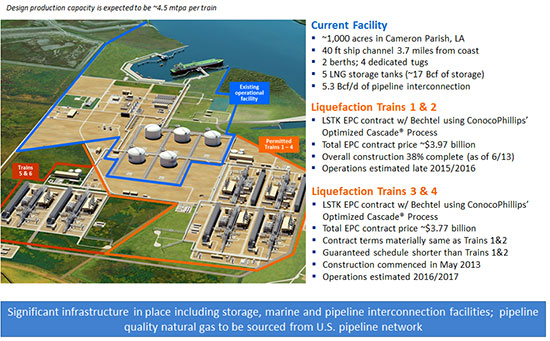

The Chenier Energy Partners have plans to construct six liquefaction trains at the Sabine Pass Terminal facility. They will each have a production capacity of 4.5mtpa(million tons per year). The constructions of the first two trains are complete. Trains 3-5 are expected to be online in 2017-2019. Train 6 received approval from the U.S. Department of Energy but the final investment decision is still pending. The first train is expected to start operations as early as 1Q18.

The Sabine Pass LNG terminal also includes existing infrastructure of five LNG storage tanks with the capacity of 17 billion cubic feet. Two docks can accommodate vessels with nominal capacity of up to 266,000 cubic meters and vaporizers with regasification capacity of 4 billion cubic feet per day. The terminal is interconnected with several interstate pipelines through Cheniere Energy Partners 94 mile Cheniere Creole Trail Pipeline.

Apart from the Sabine Pass Terminal, Cheniere Energy is developing an LNG export terminal at Corpus Christi TX. In Stage 1 of the project, Cheniere Energy started developing Train 1-2 each with a production capacity of 4.5 million tons per year. In Stage 2, Cheniere Energy plans to construct Train 3. It received the necessary regulatory approval but the final investment decision is pending. In June 2015, Cheniere Energy announced plans to add two additional trains. The full project is expected to be online 1Q21.

As of July 2014 the US Department of Energy received 40 applications to export LNG to non-FTA(Free Trade Agreement) countries. As of January 2016, the department approved six facilities, five are under construction. The parties that have shown interest in LNG export include Dominion Resources, Energy Transfer Equity, Kinder Morgan, and Cheniere Energy Partners. Dominion Resources and Energy Transfer received approval. Dominion Resources started construction. The final investment decision is pending on Energy Transfer’s Lake Charles LNG export project.

The LNG market opened up when three of the world’s largest LNG importers-Japan, South Korea, and China, experienced a decline in LNG demand in 2015. According to the EIA, the total LNG imports from these three nations declined by an average of 1 billion cubic feet per day. This was the first annual decline in the combined LNG imports in these countries since the global economic crisis of 2009. With so many players showing interest in the LNG export as well as the decline in LNG demand, is there going to be demand for the supply?

While players like Kinder Morgan are waiting for LNG export approval for the US Department of Energy, Cheniere Energy enjoys the unique first mover advantage. Even though crude prices are at an all-time low, supporters of LNG exports say it would provide a source of domestic economic stimulus and increase U.S. leverage overseas. A federal report found the increase in U.S. natural gas production could support as much as 80% of the potential increase in demand resulting from the increased LNG Exports. Icahn Capital is promoted by well-known investor Carl Icahn. Last year, it disclosed its investment in Cheniere Energy. Icahn Capital holds 14% in Cheniere Energy. It placed two members on the company’s board in August 2015. However, not many investors are optimistic about the LNG opportunity. At a broader level, 73% of analysts rate Cheniere Energy a “buy.” Its midstream partners are rated 82% “buy” of the analysts surveyed by Bloomberg.

In short, Cheneire Energy Partners and Icahn Capital are betting on themselves going first into LNG exporting business. Will the demand for LNG stay flat? Will the 2016 oil and gas bubble drastically affect the outcome? Although many analysts are rating the project a “buy,” many investors are hesitant to jump on board in the midst of plummeting crude prices. Will the opportunity to export help relieve the prices and open a new market for onshore production? Time will tell how these factors will change the landscape of exporting LNG. One thing is for certain, the approval to export from the US Department of Energy holds a great opportunity for domestic growth.

Click here for project overview: